REASONS TO BE GRATEFUL YOU’RE NOT LIVING IN SPAIN (OR LOUISIANA)

January 25, 2017

In all of the Spanish regions where inheritance is covered by the Spanish Civil Code, children are legally entitled to two-thirds of the deceased…

Special Administrators are a Valuable Resource

September 29, 2016

Special Administrators

Assets which are not subject to probate administration are referred to as “non-probate assets”. Examples include…

Prince’s untimely death reminds us of the importance of having an Estate Plan

May 11, 2016

The Importance of an Estate Plan

According to his sister, Prince Rogers Nelson (“Prince”), died without a Will or trust with an estate estimated…

Family Member NOT Appointed Administrator

April 29, 2016

The appointed Administrator is the person you nominate in your Last Will and Testament to be in charge of your estate. Assuming the person…

Caring for our animals through the use of a Pet Trust

March 31, 2016

Forbes magazine reported that in 2015 Americans spent more than $60 billion on their pets. According to the American Pet Products Association…

Estate Tax Exemption

March 15, 2016

For 2016, the estate tax exemption is $5.45 million per individual, up from $5.43 million in 2015. That means an individual can leave $5.45…

Ashes to ashes…

December 11, 2015

A Florida couple’s twenty-three-year-old son, single and without children, died in a tragic automobile accident. He left no will and no written…

Inheriting Property Subject to a Mortgage

November 5, 2015

Generally, a creditor’s notice must be sent to every creditor to whom the Decedent owed money to at the time of death. NRS 147.010. If…

Estate Administration

August 28, 2015

Estate Administration What exactly is estate administration? This is a question that you may find you are asking yourself if you have just lost…

Contesting Wills

July 22, 2015

There are many times when people learn that a loved one has passed, and then discover that the Will they left behind wasn’t exactly what they…

All is not lost!

July 20, 2015

Dealing with the loss of a loved one is difficult, at best. Now, you are trying to handle the passing of their assets and know that your mother or father had a Will; however, it’s nowhere to be found.

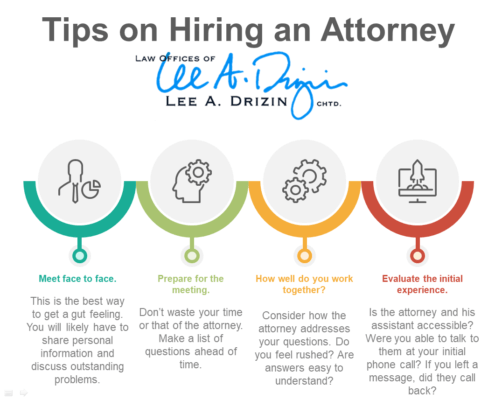

Why Hire A Probate Attorney

June 5, 2015

Why hire a Probate Attorney when you are dealing with an estate? Well, there is a really good reason for that. When someone you know passes away,…

Fiduciary Duty

May 1, 2015

Fiduciary Duty: Trustees and personal representatives of an estate are fiduciaries and have certain duties and obligations that must be met. If they breach their duty as a fiduciary, they may be removed from their role and may be personally liable for any losses that they have caused.

Probate Terminology

April 30, 2015

If you are in the position of serving as the administrator or executor of an estate, you may be feeling overwhelmed. In addition to the loss…

Letters of Entitlement

April 16, 2015

In Nevada, there are several different methods set forth to administer an estate. Which one is used depends a lot on the size of the estate,…

Divorce is going to the dogs!

January 27, 2015

I ran into an old colleague the other day. He recently broke off a long term engagement with his fiancé. He proceeded to tell me that they…

Save Time & Money With These Helpful Probate Shortcuts

January 13, 2015

When a loved one has passed away, the last thing anyone wants to do is deal with frustrating legal processes. You deserve to have any assets…

Will May be Contested Even When Testator Possessed Capacity

December 23, 2014

Even when a Decedent is believed to have had testamentary capacity at the time a Will was executed, the document may be set aside if it was the…