WHAT IS UNDUE INFLUENCE?

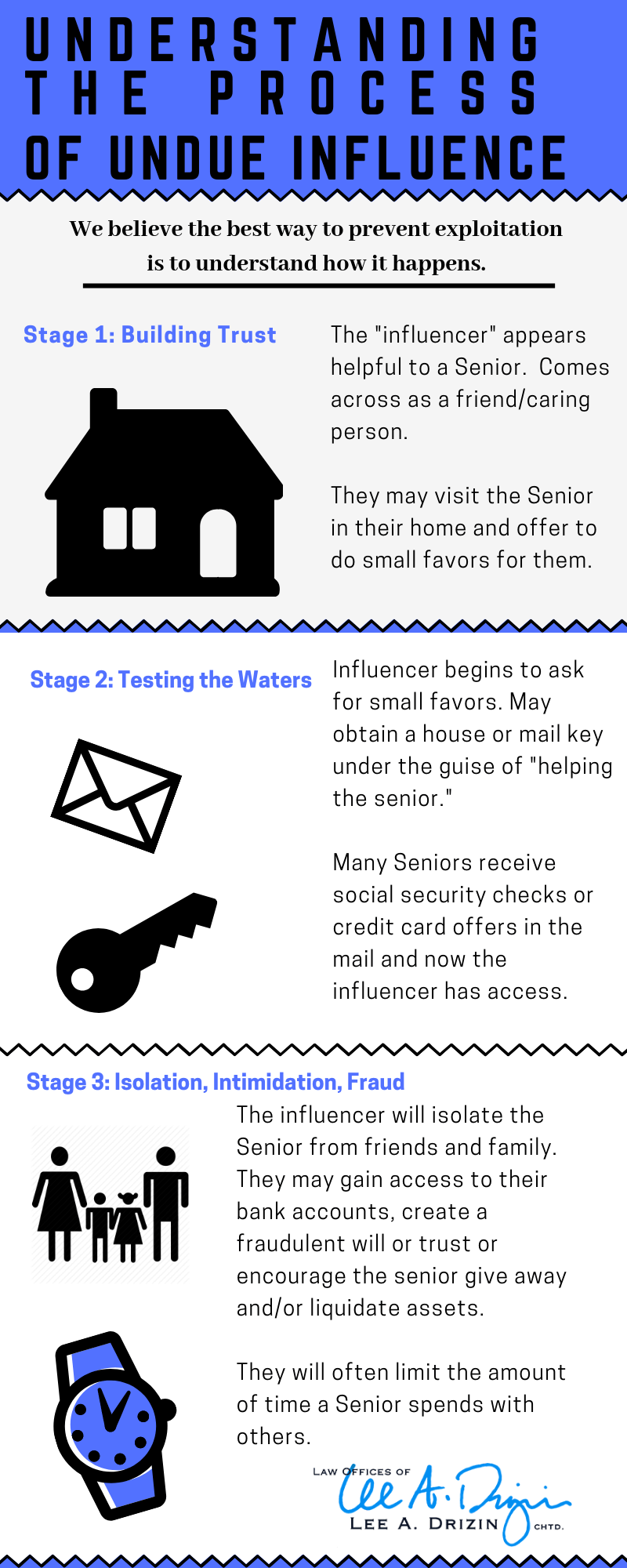

Licensees should be aware that transfers that are the result of undue influence are void. Undue influence is the misuse of one’s role and power to exploit the trust, dependence, and fear of another to deceptively gain control over that person’s decision in a particular matter. Certain transfers are presumed to be the result of undue influence, and void, if the transfer is to a transferee who is:

(a) The person who drafted the transfer instrument;

(b) A caregiver of the transferor;

(c) A person who arranged for or paid for the drafting of the transfer instrument; or

(d) A person who is related to, affiliated with or subordinate to any person described in paragraph (a), (b) or (c).

NRS 155.097.

Real Estate Agents owe an absolute duty of fidelity to their clients. Have you ever sat at a listing appointment with an elderly prospective client and his/her adult child? Who does all the talking? Does the senior seem like they really understand what is going on and agrees with the sale of their home? Doesn’t this duty require a Licensee to make an inquiry or take certain action under these circumstances?

Did you know a will or trust executed at a time the Decedent lacked the capacity is invalid?

Factors reflecting incapacity or undue influence include weak physical or mental health when the document was created:

Weak physical or mental health, isolation from all or part of the family, and changes to a Will and or Trust that are kept secret. As a consequence, the family may suddenly find that their share of the estate has been inexplicably decreased, or that they’ve been cut out all together.

Presumptions of Undue Influence and Incapacity:

In 2011 the Nevada Legislature enacted a law that provides that certain dispositions are presumed to be the result of undue influence. Any transfer of assets pursuant to a will or trust after a person dies is presumed to be void (invalid) if the transferee is:

(a) The person who drafted the Will or Trust;

(b) A caregiver of the transferor;

(c) A person who arranged for or paid for the drafting of the transfer instrument; or

(d) A person who is related to, affiliated with or subordinate to any person described in paragraph (a), (b) or (c).

Even if a presumption does not apply, if a will, codicil, trust, or amendment are the result of undue influence, an interested party may challenge the document as void. NRS 155.097. A person found responsible for undue influence may be responsible for costs and reasonable attorney’s fees to initiate a proceeding to challenge a document. However, an action to challenge a will on the basis of undue influence MUST be filed within a specific time after the will is admitted to probate or the claim is barred.

If you suspect undue influence, it is important to seek the guidance and representation of a knowledgeable Nevada Probate Law Attorney with experience in the litigation of undue influence and capacity issues, probate administration, and estate planning matters.