Why Estate Planning Shouldn’t Be a DIY Project

These days, social media can help you figure out just about any do it yourself (DIY) project. Do you want to fix a leaky faucet, make your own soap, install your own garage door opener? Chances are there’s a video or online blog article that explains exactly what to do.

While the internet can provide a lot of information to help you solve a lot of life’s problems, I’ve found DIY projects for executing your own estate planning documents to be a bad idea. There’s DIY kits available online or sold on shopping channels, not to mention the plethora of fill in the blank forms available at form stores.

It all sounds simple, convenient and less expensive than hiring an attorney, but some of the messiest probates our office handles is directly related to these DIY estate plan projects gone horribly wrong.

Using an online do it yourself will and/or trust kit to create your estate plan is risky business. In Nevada, NRS 133.040 requires certain provisions to be met for the will to be valid. If these requirements are not met, then the decedent (person who died) will be treated as having died “intestate” meaning the will is not followed and the assets are distributed based upon Nevada law.

Why is DIY Estate Planning a Bad Idea

Trying to save a few hundred dollars in estate plan up-front costs can end up costing the estate thousands of dollars in a will contest. Estate planning documents that are concise and properly executed by a competent Nevada Estate Planning attorney can diminish the stress level that occurs after a loved one dies.

Unfortunately, families can often fall apart after the matriarch or patriarch dies. Siblings may begin to argue with one another if one person is not named as the executor of the estate. Well written documents set forth a plan so that chaos and confusion can be avoided.

The executor is required by law to distribute the assets according to the Decedent’s wishes. In addition, the guess work is taken away, as a good estate planning document will detail any last wishes as to where they should be buried or if they desire to be cremated.

A trust document can be even more specific and addresses a greater number of potential issues. Parents often know best and they can set up a trust document that allows for their children or grandchildren to receive a set sum of money for a length of time or to wait until a certain age for asset distribution.

For example, grandparents may decide to give each grandchild $20,000 but said amount is not distributed until the child reaches age 26. If this provision is not spelled out, the $20,000 would be distributed to each grandchild at age 18 to spend at their sole discretion.

A will allows the decedent to leave money to charity, a friend or significant other or even disinherit a sibling, child or parent. Each family situation is unique and the person who spent a life time acquiring the assets should ultimately be the one to decide how the assets are distributed.

A trust can also allow a person to set up a special needs trust for a person who had capacity issues or for a pet. Trusts can also help the estate avoid probate fees. It’s also advised to name a guardian or successor guardian for minor children.

Why You Need to Hire an Attorney

The best way to save money on your estate plan is to put a lot of thought into what you want before you meet with an attorney and properly execute your estate plan documents before your incapacity or death.

The potential problems of using DIY estate planning tools can result in serious problems, especially for your heirs. If the state changes a law that could impact your estate plan, your attorney can inform you of these changes.

Software vendors generally won’t do that. In some states, your spouse is entitled to a share of your estate even if the two of you agreed that you wouldn’t inherit from one another – a scenario that isn’t uncommon in marriages that occur later in life when both people have children from prior marriages.

In summary, finding an estate planning attorney who answers your questions and helps you craft an estate plan for your unique situation is money well spent.

Download our free e-book about Nevada Estate Planning for a straightforward overview of the importance of your Nevada Estate Plan. If you already have a trust, visit our website to learn the importance about an estate plan review. When you hire a Nevada Attorney, you could have your estate plan documents completed within weeks and we promise to make it easy, affordable and best of all executed properly.

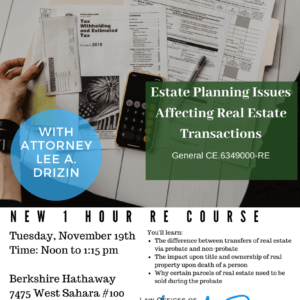

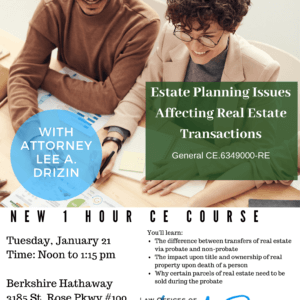

For more than 30 years, Attorney Lee A. Drizin has practiced in the areas of estate planning, probate, trusts, guardianship and real estate matters representing clients throughout the state of Nevada.

Drizin Law is providing this information for educational purposes only. It should not be construed as legal advice or a legal opinion as to any specific facts or circumstances. This information is based on general principles of Nevada law at the time it was created and you should be aware laws frequently change. Moreover, the laws affecting you may differ depending on the circumstances. You should consult with a qualified attorney in your own state or jurisdiction concerning your particular situation. Review of this information does not create an attorney-client relationship.