What are Letters of Testamentary?

When someone who wrote a will dies, the person named as the Executor of the Estate in the Will must file with the court to obtain Letters Testamentary before they can legally act in their official capacity as Executor of the Estate.

As soon as the person passed away, the ability to use their assets to pay bills, trade their stocks and bonds, buy or sell real estate, and other financial transactions involving their assets ceases. If someone had a durable Power of Attorney, their ability to act on behalf of the deceased ceases with their death, even if the same person will be the Executor of the Estate.

Letters Testamentary

Letters Testamentary are an official document issued by the probate court that gives the Executor the authority to access the deceased’s accounts, pay their debts and bills, sell their assets, represent the estate in lawsuits, inventory the assets, and pay to have the assets appraised, manage their investment accounts, and distribute the assets to the heirs after the court approves the distribution plan.

How to Obtain Letters Testamentary

Within thirty days of the person’s death, a copy of the will and their death certificate should be filed with the probate court in the county where the deceased resided. Shortly thereafter, you or your attorney will file a petition requesting that you be granted Letters Testamentary.

The probate court will schedule a hearing where they will verify that the individual named as Executor in the will is able to fulfill the duties. In addition to not being a convicted felon, the Executor must be an adult of sound mind to qualify. Once the court is satisfied with the Executor, a Letters Testamentary will be issued that provides the Executor the legal right to settle the .

Getting Appointed Executor

If the are over $100,000 when there is no surviving spouse an Executor must be named by the court to handle the estate. The Nevada probate court provides simplified processes for some smaller estates. The Executor must be appointed and Letters Testamentary granted by the court so the Executor can begin the process of settling the estate.

When determining the value of the estate, do not include assets that pass directly to the beneficiary such as life insurance and retirement accounts where a beneficiary was named, assets owned by a trust, and joint accounts with rights of survivorship.

Executors have a fiduciary responsibility to handle the estate according to the law, putting the best interest of the beneficiaries before their own interests.

The will generally states whether the Executor can act without bond or if a bond is required. A bond protects the heir’s interests against malfeasance by the Executor. Being the Executor does not entitle you to assets from the estate although heirs may act as the Executor. The Executor may be entitled to a fee as compensation for their work.

Applying for Letters Testamentary

When you apply for Letters Testamentary, a preliminary statement indicating the approximate value and debts of the estate must be filed with the application. You will also need to list all the family members of the deceased, including estranged family who are as close or more closely related to the deceased than you are. For example, if you are a grandchild of the deceased, you would need to list the spouse, adult children, parents (if living), siblings, and any other grandchildren of the deceased.

You will need a certified copy of the decedent’s death certificate which is usually available from the health department. You will need to show that you have a reason to get a copy of the death certificate. The will can be a formal document drafted by an attorney, but it can also be a holographic will in the decedent’s own hand. In some cases, electronic wills that meet specific criteria will be accepted by the courts as well.

Contact a Probate Attorney

Nevada probate courts strongly encourage Executors to obtain the assistance of a probate attorney to assist them with the complex probate process. Mistakes can be costly and time-consuming. The self-help center doesn’t provide forms for estates of this size because they don’t want Executors to attempt this without assistance. Probate will involve hearings, documents that must be drafted for the court, and other activities that must be completed in specified ways to comply with the legal requirements.

If you have been named as the Executor of an Estate and you are willing to serve as the Executor, you will spend considerable time fulfilling your duties. Being guided by counsel that is assisting you will make the process easier and may save you considerable time.

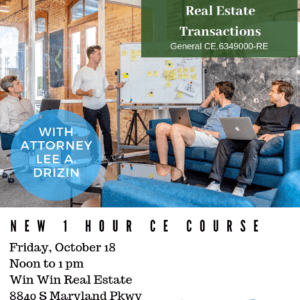

For more than 30 years, Attorney Lee A. Drizin has practiced in the areas of estate planning, probate, trusts, guardianship and real estate matters representing clients throughout the state of Nevada.

Drizin Law is providing this information for educational purposes only. It should not be construed as legal advice or a legal opinion as to any specific facts or circumstances. This information is based on general principles of Nevada law at the time it was created and you should be aware laws frequently change. Moreover, the laws affecting you may differ depending on the circumstances. You should consult with a qualified attorney in your own state or jurisdiction concerning your particular situation. Review of this information does not create an attorney-client relationship.