What Happens if Somebody Dies Without a Will?

If you die without a Will in Nevada your assets will pass according to the intestate laws of Nevada. If you are married at the time of death, it must be determined whether your property is community or separate property. Assets acquired during a marriage are considered “community property” unless otherwise stated. Receiving property as a gift or inheritance are not community property, unless commingled with other community assets.

Dying Without a Will

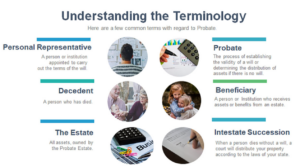

When you die without a will, your surviving spouse is entitled to your one-half interest in the community property. However, if there are separate property assets, the distribution is very different. If the person passing away (the “Decedent”) leaves a surviving spouse and only one child, or the lawful issue of one child, the estate goes one-half to the surviving spouse and one-half to the child or the issue of the child.

If the Decedent leaves a surviving spouse and more than one child living, or a child and the lawful issue of one or more deceased children, the estate goes one-third to the surviving spouse and the remainder in equal shares to the children and the lawful issue of any deceased child by right of representation. Without a surviving spouse dividing assets among children and lawful issue of deceased children becomes necessary. For example, when Frank passes his sons, Frank, Jr. and Deans survive him. His wife and son, Sammy, who had two children -Joey and Peter- predecease him. Frank’s family inherits his estate with 1/3 going to Frank, Jr.; 1/3 to Dean; and 1/6 to Joey; and 1/6 to Peter.

When you die without a Will or surviving family in Nevada, there can be significant consequences. The Nevada intestacy laws address numerous different scenarios including when a person is not survived by a spouse or children. There is also a process for the property to pass to the State of Nevada in certain situations if no family of the Decedent or a predeceased spouse can be located.

Benefits of a Will & Trust

A significant advantage of a Will is controlling who you give your assets to upon dying. The use of a Revocable Living Trust provides even more control as to the timing of those distributions. For example, 50% upon attaining the age of 25 years and the balance at age 30. Remember, intestacy laws only apply to probate assets. They do not apply to control payable on death designations or assets owned as joint tenants with rights of survivorship.

Drizin Law is providing this information for educational purposes only. It should not be construed as legal advice or a legal opinion as to any specific facts or circumstances. This information is based on general principles of Nevada law at the time it was created and you should be aware laws frequently change. Moreover, the laws affecting you may differ depending on the circumstances. You should consult with a qualified attorney in your own state or jurisdiction concerning your particular situation. Review of this information does not create an attorney-client relationship.

Biography

Lee is an Nevada Attorney with 30 years of experience. He focuses on probate, wills, trusts, guardianship and real estate for a wide range of clients.

He has been representing families for more than 30 years in all aspects of probate, trust and guardianship administration including, but not limited to, commencement of proceedings, will and trust contests, accountings, and sales of real estate.