Living Trust vs. Will: What is the Difference?

Let’s face it. Nobody wakes up excited to plan their estate. But the truth is, getting your affairs in order is one of the most thoughtful things you can do for your loved ones. At the heart of every good estate plan is this big question:

Do I need a will, a living trust, or both?

You might have heard both terms tossed around, maybe even used interchangeably. But they’re not the same. They each play very different roles in how your property is handled after you pass away.

What Is a Will?

A will is a legal document that outlines who should receive your assets when you pass. This includes your home, money, and personal property. Think of a will as your final letter to the world. It’s a legal document that spells out who gets what when you’re no longer around. Want to leave your house to your kids? Your vinyl collection to your best friend? A will lets you say so.

But that’s not all. A will also allow you to:

- Name guardians for your minor children

- Choose an executor (someone to carry out your wishes)

- Make specific gifts to charities, friends, or relatives

Wills must go through probate, a court-supervised process that validates the document, pays off your debt, and distributes your assets. A will can also include a testamentary trust, which is a trust that only goes into effect after your death, often used to manage money for children or dependents.

What Is a Living Trust?

There are two main types of trusts: revocable trusts and irrevocable trusts. Revocable trusts can be changed or cancelled during your lifetime, while irrevocable trusts cannot be altered once created. A living trust is like a private treasure chest you set up during your lifetime. You move your assets, like your home, investment, and bank account, into the trust. While you’re alive, you manage it like normal. When you’re gone or if you become incapacitated, your chosen “successor trustee” takes over without needing to go to court.

People love living trusts because they avoid probate. That means your loved ones can skip the court delays, legal fees, and public exposure that often come with a will. But don’t worry. You’re still in full control while you’re alive. You can change, update, or revoke the trust whenever you want.

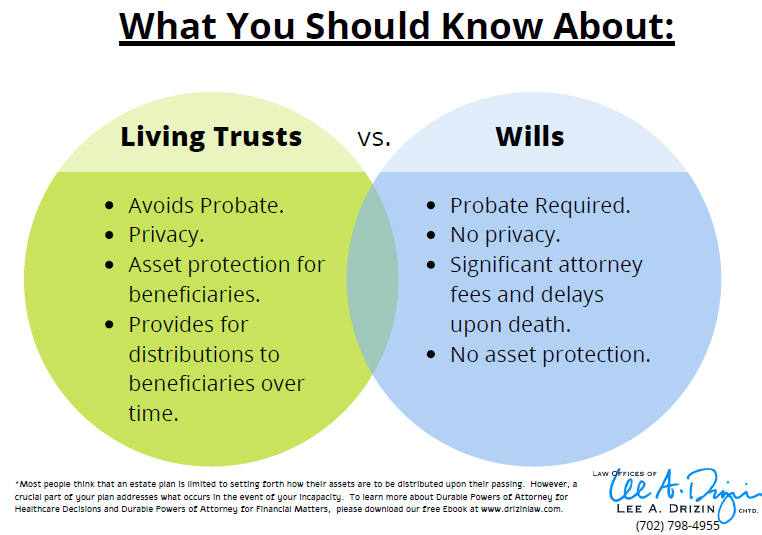

Key Differences Between a Living Trust and Will

Before you decide which option is right for your estate plan, it’s important to understand how a living trust and a will operate differently. Let’s begin with one of the most crucial distinctions: how each handles the probate process.

Trust vs Will: Probate Process

Wills must go through probate, a court-supervised legal process that validates the document, pays off your debt, and distributes your assets. This is where having a good probate attorney can make all the difference, helping your loved ones navigate the process smoothly. The exact process and timeline can vary depending on state laws, but the Nevada probate process can take several months or more to complete.

A living trust skips probate entirely. Your assets go directly to your beneficiaries without court delays or fees. Any assets left in your name alone at the time of your death, whether real estate or personal property, will be subject to probate if there is no trust in place.

Will vs Trust: Privacy and Public Record

Once the will enters probate, it becomes a public document. Anyone can see what you owned and who you left it to.

A living trust is totally private. No public record. No nosy neighbours know your business.

Living Trust vs Will: Control Over Assets

Your will only kicks in after death. It can’t help if you’re alive but incapacitated.

A living trust operates while you’re alive and after death. If you become ill or unable to manage your affairs, your successor trustee can step in without a court-appointed guardian.

Will vs Living Trust: Costs and Complexity

The will is cheaper and simpler to set up. But it may cost more in the long run due to probate fees.

A living trust costs more upfront and takes effort to fund by transferring your assets into it. But it can save your estate significant time and money later.

Pros and Cons of a Living Trust

| Pros | Cons |

| Skips probate | Higher upfront cost |

| Faster distribution to beneficiaries | More complex to set up than a will |

Pros and Cons of a Will

| Pros | Cons |

| Easy and affordable to create | Goes through probate (time-consuming and expensive) |

| Allows you to name guardians for minor children | Becomes public record |

| Suitable for simple estates | Doesn’t help during incapacity |

| Can be updated easily | May require court involvement to settle disputes |

Do You Need Both a Living Trust and a Will?

Yes.

Even if you have a living trust, you still need a pour-over will. This catches any assets you accidentally left out of the trust and directs them to go into it after your death.

And remember, only a will can name guardians for minor children. So, if you have young kids, don’t skip this part.

Keep in mind that assets like life insurance or retirement accounts with named beneficiaries usually bypass probate altogether, whether or not you have a will or trust.

Learn more about Living Trust vs Will in this video from our attorney Lee A. Drizin.

Choosing the Right Option for Your Needs

- Have young kids? You’ll need at least a will to name guardians.

- Have minor children, multiple properties, or privacy concerns? It might be time to create a living trust with the help of an estate planning attorney. While Nevada does not currently impose a state-level estate tax, a living trust can still help with federal estate tax planning and provide flexibility for larger estates.

- Want to keep things private? Trust all the way.

- On a tight budget? A simple will is better than nothing.

When in doubt, speak to an estate planning attorney. They can help you build a strategy that fits your life, your family, and your goals without overcomplicating things.

So, what’s the verdict? A will is like the starter pack. It’s simple, effective, and essential for naming guardians and spelling out your wishes. A living trust adds next-level protection. It avoids probate, maintains privacy, and helps your family carry on without court interference. The truth is, they’re not enemies. They work best as a team. Because when it comes to your legacy, it’s not just about what you leave behind. It’s about how smoothly, private, and lovingly it gets passed on. Ready to take the next step? Talk to an experienced probate lawyer today and create a plan that brings you and your loved ones peace of mind.